Paycheck Protection Program - Second Draw

The SBA Portal for submitting PPP applications has been closed to most banks.

New applications from participating CDCs (Certified Development Companies), SBA Microlenders, CDFIs (Community Development Financial Institutions) and MDIs (Minority Depository Institutions) will still be accepted through May 31st, or until the funds set aside for them have been exhausted.

To find an eligible lender that is still participating in PPP, please visit the SBA's website.

If you previously received a PPP Loan, you may be eligible to apply for a fully-forgivable Second Draw PPP Loan under the Economic Aid Act.

Are you eligible for a Second Draw PPP Loan?

If you can answer yes to all of the questions below, you are eligible for a Second Draw PPP Loan:

- I have used, or will use, the full amount of my PPP loan before disbursement of a Second Draw Loan.

- I have no more than 300 employees.

- I do not plan to apply for or receive a Shuttered Venue Grant, under Section 324 of the Economic Aid Act.

-

-

-

- Tax Forms: Annual IRS income tax filings of the entity are required if using an annual reference period. If the entity has not yet filed a tax return for 2020, the Applicant must fill out the return forms, compute the relevant gross receipts value, and sign and date the return, attesting that the values that enter into the gross receipts computation are the same values that will be filed on the entity’s tax return.

- Financial Statements: if the financial statements are not audited, the Applicant must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy.

- Bank Statements: The Applicant must annotate, if it is not clear, which deposits listed on the bank statement constitute gross receipts (e.g. payments for purchases of goods and services), and which do not (e.g. capital infusions).

-

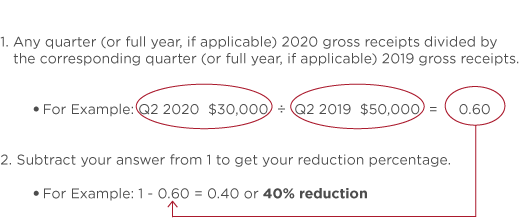

How to calculate the 25% reduction:

For more information, please visit the SBA or Treasury websites.